Business Insurance in and around Matthews

Calling all small business owners of Matthews!

Helping insure small businesses since 1935

- Charlotte

- Mint Hill

- Matthews

- Indian Trail

- Weddington

- Monroe

- Stallings

- Concord

- Harrisburg

- Waxhaw

- Pineville

Business Insurance At A Great Value!

Running a small business comes with a unique set of challenges. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including business continuity plans, a surety or fidelity bond and worker's compensation for your employees, among others.

Calling all small business owners of Matthews!

Helping insure small businesses since 1935

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a photography business, a pottery shop, or a book store, having the right protection for you is important. As a business owner, as well, State Farm agent Joe Pomykacz understands and is happy to offer exceptional service to fit what you need.

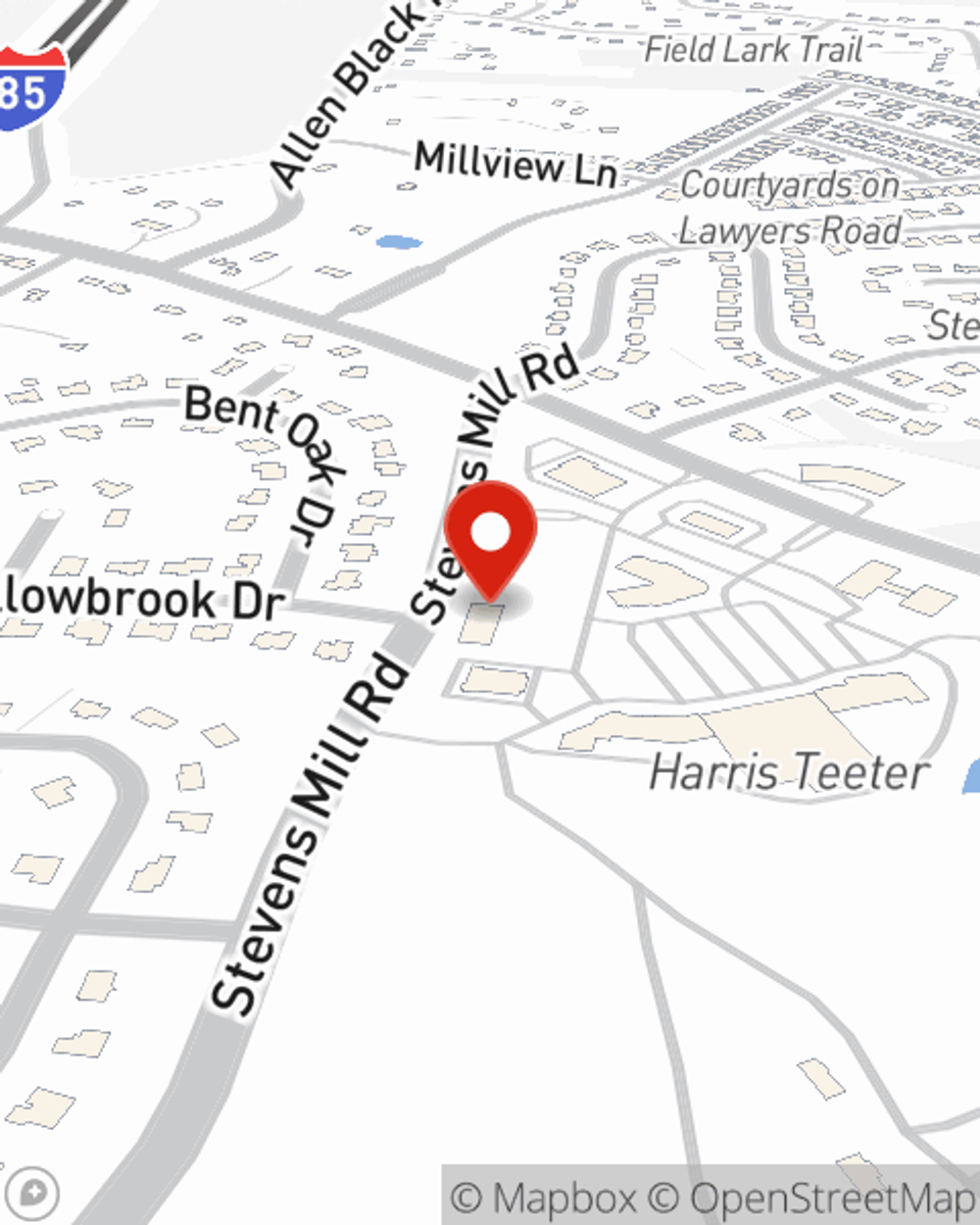

Agent Joe Pomykacz is here to explore your business insurance options with you. Contact Joe Pomykacz today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Joe Pomykacz

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.